Bank Guarantees lease and Trade On The Public Market.At start let’s see the legal use of a bank guarantees. If you ask us: is Bank Guarantees Traded on the Public Market? Our replay will be” No”. If you see a bank guarantee being traded on the public market, then that bank guarantee is a fraudulent forgery and not worth the paper it is printed on. Bank guarantees are private agreements between a bank, its client, and a beneficiary – they are not tradable items.

Obtaining a bank guarantee means approaching your bank, requesting a bank guarantee, and putting up sufficient collateral to secure it. Any other means of obtaining a bank guarantee are illegal and fraudulent, except for very rare circumstances which are connected with business financing and insurance, and have nothing to do with goods trading whatsoever.

As we have see in our earlier post Bank guarantees has 7 main categories:

1. Guarantee of payment. Secure the payment obligations of Buyer to Seller.

2. Guarantees of advance payment return. Bank is obliged to return advance payment to buyer, if seller receive an advance payment and fail to perform contractual obligations.

3. Contract execution guarantee. This is a Security of timely delivery of goods or performance of services according to a contract.

4. Tender guarantees. This guarantee plays a role of security in those cases when the Company fails to perform its obligations to tender organization or other party that is stipulated in the order received by winning the tender.

5. Guarantee in favor of the customs authorities. This guarantee is a security of obligation of the company performing import and export operations to the Customs authorities for payment of customs taxes and duties.

6. Guarantees of warranty execution. This guarantee plays a role of security of quality for delivery to the contract terms.

7. Guarantee of credit return. This guarantee is a security for repayment of credit

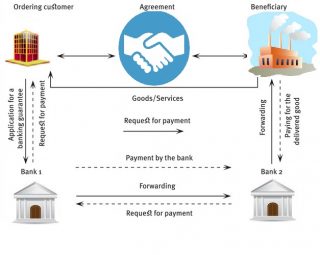

For the case of financial guarantee, the banker commits itself to reimburse the beneficiary of the guarantee the amount on behalf of its client.

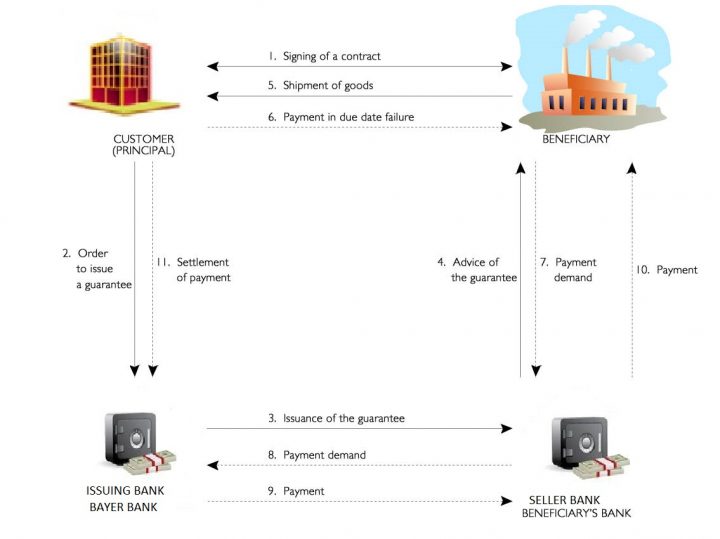

Let’s see now by daily example how BG can be used:

If you are buying for example corn from Ukraine, seller may ask for a BG to secure itself. Seller has to move his goods (corn) from farms elevators’ to port and prepare it for shipment. Letter of credit from the view of Ukrainian seller can’t guaranty the deal and that he will be paid .sow in this case you have to go for a Guarantee of payment.

If seller asks for payment in advance, to secure yourself as buyer, you must ask for a Guarantee of advance payment return. Really we do not recommend any buyer to pay in advance, only if you know very well your seller and this is not your first deal with him.

So how some people trade bank guarantees?

We can say that this case is legal and illegal in the same time, it depend how the deal is made.

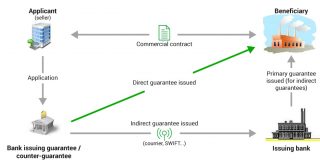

Some small trading company or buyer that faces a lack of fund may go for a bank guarantee lease.

Let’s explain you how. You are entering a deal of wheat from Ukraine, your seller asks for a bank guarantees but you are not able to provide one .in this case you run an agreement with private investors or financing organization. They will acts as guarantee of the deal by providing a bank guarantee.

Investor will be a third party in the deal. Investor’s leas their bank guarantees up front a percent or fixed sum from the benefit of the deal. For us this is the unique real and legal way to lease a bank guaranty, other offer in the internet in wish they said bank guaranty ready for delivery just you have to pay some fee or send some swift are illegal and fake. we tested a lots of offers like this and all ends by big fail and scam.All what was listed before is applicable to all countries except cypress.

in 2017 in Cypress was implemented a news low that regulate the lease of instruments.

The Finance Leasing law (72(I)/2016 (the “Law”) entered into force, in Cyprus, on 28 April 2016 with a further Financial Leasing Directive (the “Directive”) issued by the Central Bank of Cyprus on 17 February 2017.

Currently, in Cyprus, we can found a number of local Banks and private companies offer Finance Leasing services. The new directive by the Central Bank coupled with the new accounting requirements set by IFRS16 present a new challenge for organizations already operating in the leasing sector as well as for new entrants.

Then In conclusion we can say that for major case bank guarantees are not traded on the Public Market. Only some lessened companies have the low in hand to do such operation.

Most leased type of bank guarantees.

Tender Guarantee:

Is a bank guarantee by which a guarantor undertakes to pay to a beneficiary certain amount of money if a tender participant (guarantee principal) revokes its bid during the bidding process or refuses to conclude contract in accordance with conditions of the accepted tender.

Performance Guarantee:

Issued under the Seller’s instructions in favor of the Buyer as a guarantee of proper fulfillment of contract obligations by the Seller.

Payment Guarantee:

Can be issued under Buyer’s instruction in favor of the Seller. Provides payment obligation for the Buyer under a proposed contract.