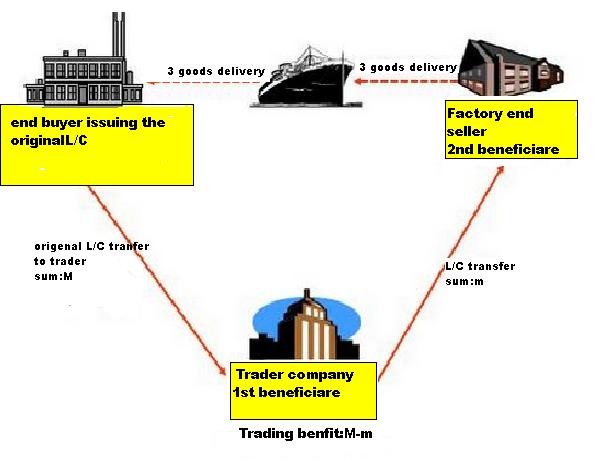

We suppose that you are a trading company and you are working with a factory to sell products to your clients. Your clients will pay for the goods by a transferable L/C. as usually price that you quote to your client is factory price plus your commission and you as many trading company dislike to show how much is the commission or benefit that you will make. So you try to see the situation like this: buyer or your client will open the L/C to your company then your bank will transfer the L/C (not issue another new L/C) to the factory.

This is possible under the Article 38 of UCP 600 which deals exclusively with Transferable LCs but you must know very well that all terms, conditions and good description that you will fix with the factory by contract must be the same as with your buyer (or client )this for first.

• the amount of the credit,

• Any unit price stated therein,

• The expiry date,

• The period for presentation,

• The latest shipment date or given period for shipment, any or all of which may be reduced or curtailed.

Second you must calculate costs and include them in your benefit unless you will work for free.

In the contract that you will sign with your client (buyer) you must see how long procedure needs to be terminated (L/C transfer, goods delivery …….) to do not pay penalty.

Below I m describing the procedure how it will looks like but remember that your bank can agree this or ask you to do some change on it and this normal as banks differ.

1) You receive a transferable L/C.

2) Request your bank to transfer the L/C with the concerns above to your supplier (factory).

3) Shipment shipped as agreed sales contract.

4) Your supplier (factory) will prepare all the documents as per L/C requirement and present to bank.

5) Your bank will advise you when they received the doc from remitting bank.

6) You accept the doc and substitute some document that was listed in the L/C and agreement (Invoice, Packing List….) and present to bank for negotiation.

7) The issuing made payment.

8) Once received the remittance from issuing bank, your bank will then made payment to your supplier (2nd beneficiary) as per credit transferred and the rest amount will remit into your account.

After this all done goods delivered your client happy and you too.

I hope this answers the question. You can read the whole of article 38 if you wish to know more about the relevant Rules.

**Please comment and correct me if you see that I v missed something in this article